Shopping without sacrificing budget & health

Over the past year, inflation has affected necessities heavily. Nationally, overall food prices increased by 10 percent last year. Egg prices went up by 60 percent, butter prices by 31 percent and lettuce prices by 25 percent.

DePaul University Economics Associate Professor Michael Miller said the U.S. has not seen this level of inflation since the 1980s. “Oh yes, it’s been a long, long time,” Miller said. “Inflation has not been an issue in this country for almost 40 years … That’s why it’s such big news.”

Miller said inflation generally occurs for one of three reasons: more demand than supply, the cost of doing business increasing and the printing of too much money by the Federal Reserve.

“In terms of the current situation, the inflation situation over, say, the past year and a half, it’s been all three,” he said.

People experience the effects of this unprecedented inflation in their day-to-day lives, especially in Chicago. According to the U.S. Bureau of Labor Statistics, the average price of groceries in the Chicago-Naperville-Elgin area increased by 7.7 percent in 2022.

According to an article published by Block Club Chicago, Chicagoans have started gardening, eating out less and being more strategic with their shopping to cope with inflation.

Most Chicago residents are more hesitant about purchasing items they don’t see as necessities, such as meat, desserts and snacks.

“We have to buy less food, and try to save as much of it as possible,” Luis Santiago of Humboldt Park told Block Club.

It’s not just grocery prices that have skyrocketed. Restaurant prices increased 6.5% in January. Lesly Ramos of Bucktown told Block Club that she and her fiance used to either go out to eat or order takeout once or twice a week. Now, they focus more on using the food they have at home.

Inflation woes hit the DePaul community as well. Senior Giorgia Fiorani started doing her own grocery shopping this past year.

Fiorani considers herself lucky because living with her family in Rogers Park allows for extra money to spend on grocery shopping once a week. The rising prices of everything are often discussed between her and her friends.

“The general consensus I hear is people just not eating either fruits or vegetables and stuff,” she said. Instead, her friends tend to stick to carbs and other affordable food items.

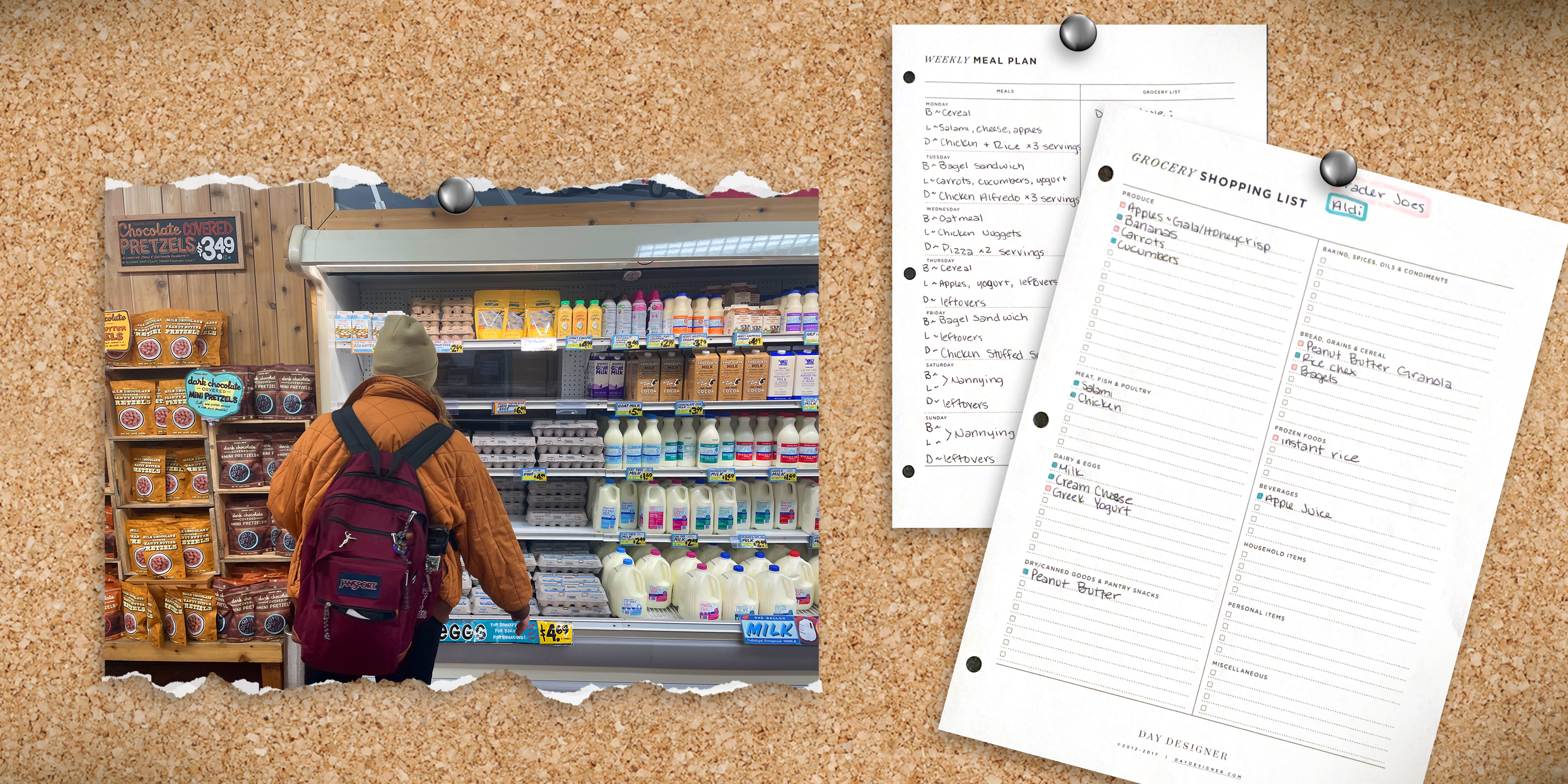

It is possible to shop and eat healthy on a college student budget, even during times with high inflation. According to Kiersten Hickman, a freelance journalist certified in health and nutrition and author of the newsletter Forkful, you have to be strategic.

“Eating healthy isn’t about buying all of the fancy products or foods or supplements,” Hickman said. “It doesn’t mean shopping at expensive specialty stores like Whole Foods and such, even though many healthy gurus and influencers online would make you think that that is what you need to do.”

While the produce section can look appealing, she explains that fresh fruit and vegetables tend to go bad quickly, especially when shopping for one person.

“I highly suggest, in terms of saving money and having food that is still nutritious and good, to look in the canned food section, in the dry food section and even in the frozen section,” Hickman said.

Despite the stigma around frozen produce, it actually can be more nutritious than fresh food. Foods are frozen at their peak nutrition level, making them better for you than products sitting on display.

“Frozen foods are great, and they’re cheap. Same with canned foods,” she said.

Canned foods are also stigmatized as they are known for containing high levels of sodium. However, according to Hickman, more regulations are being passed in regards to sodium and BPA lining, an industrial material often associated with the production of plastic. Now, it has been banned from being sold in canned food.

A lot of frozen and canned foods are already plant-based. Hickman recommends trying to eat more plant-based items as they’re both healthy and cheap.

“You can simply make plant-based with a package of rice, a can of chickpeas and some frozen foods,” Hickman said.

When it comes to splurging, Hickman recommends doing so on meat and high-protein products.

“The nice thing about animal proteins like chicken and eggs and things is that they are known as complete proteins,” Hickman said. “They have the perfect ratio of essential amino acids.”

A little bit of planning can go a long way when saving money. Hickman feels it’s important to understand what you like and what you already have at home before going grocery shopping.

“Plan out what you want to cook during the week and create a list,” Hickman said. “That is the easiest thing to do because you’re going to go to the store with that set list, you know what you’re going to spend, and then you also know what you have.”

It’s also important to plan for leftovers. Often, recipes will make several servings, and if you’re only cooking for one person, one recipe could be several different meals.

Shopping on a budget can be a struggle for college students, but the economy might give them a break soon. Miller believes that the end is in sight due to fixes in the supply chain, historically low unemployment and the Federal Reserve gaining control over the money supply.

“My guess, and the guess of many economists, is that slowly, over the next six to eight months, inflation will decline,” Miller said. “Maybe in a year or so, we’ll be back closer to where the Fed wants it to be, which is two percent.”

Header Illustration by Magda Wilhelm

NO COMMENT