On a rainy Saturday afternoon in November, eight Pilsen community members gathered into a small room seeking financial advice. No sign up was needed — everyone is invited to these monthly financial workshops, hosted by The Resurrection Project.

Named “one of the city’s strongest community development corporations” by the Local Initiative Support Corporation, The Resurrection Project was founded in 1990 to combat violence in Pilsen through the enhancement of community assets like safe housing and clean streets. Now it helps Chicago residents cope with gentrification in the Pilsen community and beyond by promoting financial wellness and building community wealth.

One of the key ways they do so is through financial workshops, which focus on a variety of money-related themes like helping families avoid going into debt and providing education on what to do in the event of eviction or foreclosure, among other topics. Along with these services, they also provide the community with a series of affordable housing options, as well as medical and school assistance.

“Here in the U.S., everything revolves around credit,” Sandy Guzman, the financial empowerment manager and financial coach at The Resurrection Project, said at the workshop. She added: “I know all of us in this room have taken financial advice from family friends, or have heard from word of mouth and regretted it. Well, I’m here to give you the right advice and some tips on how to manage your money better.”

Money management is especially important in Chicago neighborhoods like Pilsen, where rising rents have driven many Latinx families out of their communities. The declining number of Latinx households in Pilsen began around 2010, when whiter, wealthier renters began making their way into the neighborhood. To stave off these effects, The Resurrection Project’s financial wellness programs offer advice on achievable long-term financial stability.

“With financial stability and the community getting educated on mortgages, foreclosures and all the steps that go into buying a home, it gets community prepared for if any situation were to happen,” Guzman said. “Our mission is educating to avoid foreclosure. ”

Financial experts like Guzman lead workshops for anyone who is interested, and a variety of people show up hoping to gain financial acumen, or preparation on how to go about buying a home.

“Families that do go to these classes are usually financially stable because most of the time they are looking into buying a home. It’s not always families, and it is not always for looking to buy a home. Some people just want to get informed,” said Guzman.

Couples and single residents attended the November workshop, which was part of a two-part workshop series on home-buying, with a lot of questions to ask. Before anything started, everyone introduced themselves with their first memory of savings.

For this workshop in particular, attendees not only got financial advice from the workers at The Resurrection Project, but also professional experts that came in to share tips. This workshop featured Joel Contreras, a private management banker from the mortgage company Neighborhood Loans. For the first part of the workshop, participants got a packet with fake numbers showing how everything should look in a closing disclosure when buying a home, which Contreras went over step-by-step. For the second part of the workshop, an attorney came in on a different day to go over other aspects of the home-buying process with the same group.

Guzman noted that in the Latinx community, people often base financial decisions based on how others dealt with a similar situation, not always acknowledging that every situation is different. These workshops are meant to prevent that problem. Some people attend looking to buy a home, and some looking for ways to improve their credit. Most participants said they were not dealing with foreclosure, though the homeowner’s department of The Resurrection Project does deal with foreclosures cases. Guzman mentioned that the organization is seeing more cases where people had a foreclosure two or three years ago and now are looking to purchase a home.

Alma Martinez, a participant at the home-buying workshop, was looking to move out of Little Village to the Loop.

“I’m looking to move to the city because of my job,” she said. “I do see that in my neighborhood people are coming from Pilsen because Pilsen is too expensive now.”

These services are not only for Pilsen and Little Village residents, but for anyone looking for advice or more information on preparing financially to take a big leap. “Participants in these workshops are usually referred by lenders or hear from word of mouth that these workshops are offered every month in Spanish and English,” Guzman said.

Financial empowerment is always important, and The Resurrection Project isn’t concerned solely with issues related to gentrification. But it’s difficult to discuss financial empowerment without examining the factors that led to some residents to become financially vulnerable in the first place.

The shift toward gentrification began a decade ago during the Great Recession. According to “The Trajectory and Impact of Ongoing Gentrification in Pilsen,” a study done by the University of Illinois at Chicago’s John J. Betancur and Youngjun Kim, investors’ goals during the recession were to obtain foreclosed homes, short sales and rental homes in low-income neighborhoods — all while patiently waiting to sell them to a new higher-income crowd and bring in new businesses.

Lenders used the recession as a way to get closer to their overall goal: Obtaining homes that were on the verge of being lost by families to bring in a more high-class clientele. The lenders were raising the prices on these buildings knowing that the neighborhood was already middle class, and many Latinx households were not able to afford the new real estate.

“The lenders were taking advantage of the vulnerable,” Guzman said.

A sign on the outside of Pilsen Alliance. It reads ‘Barrio does not sell you love it, you defend it’. (Jocelyne Nuñez, 14 East)

Pilsen, a predominantly Latinx community, is home to many people who emigrated from Mexico and made this their first American neighborhood back in the 1960s. But over the past two decades, there has been a decline in the Latinx population living in Pilsen, and the rise of whites becoming residents. Based on data from the U.S. Census, the share of Hispanic residents living in Pilsen went from 89 percent in 2000 to 81.6 percent in 2013, and the share of white residents in Pilsen increased from 8.2 percent to 12.4 percent.

The whole community has seen a decline in population, but some areas are getting hit more than others. West and central Pilsen have lost more Hispanic households than the east side. From 2000 to 2010 there has been a decline of 1,310 Hispanic families on the east side, a decline of 4,946 in central Pilsen and a decline of 3,235 in west Pilsen, according to the U.S Census data.

“Pilsen has been divided,” Guzman said. “It used to be just Pilsen but now west Pilsen is the ‘uglier’ part of Pilsen and east Pilsen is the more gentrified side, the more expensive side. In west Pilsen, a home was sold for $1.7 million, and it was a home that was falling apart. These developers pay it because they know they will make a profit out of it. That’s catered to a different demographic. When is the Latino community going to afford that with minimum wage jobs?”

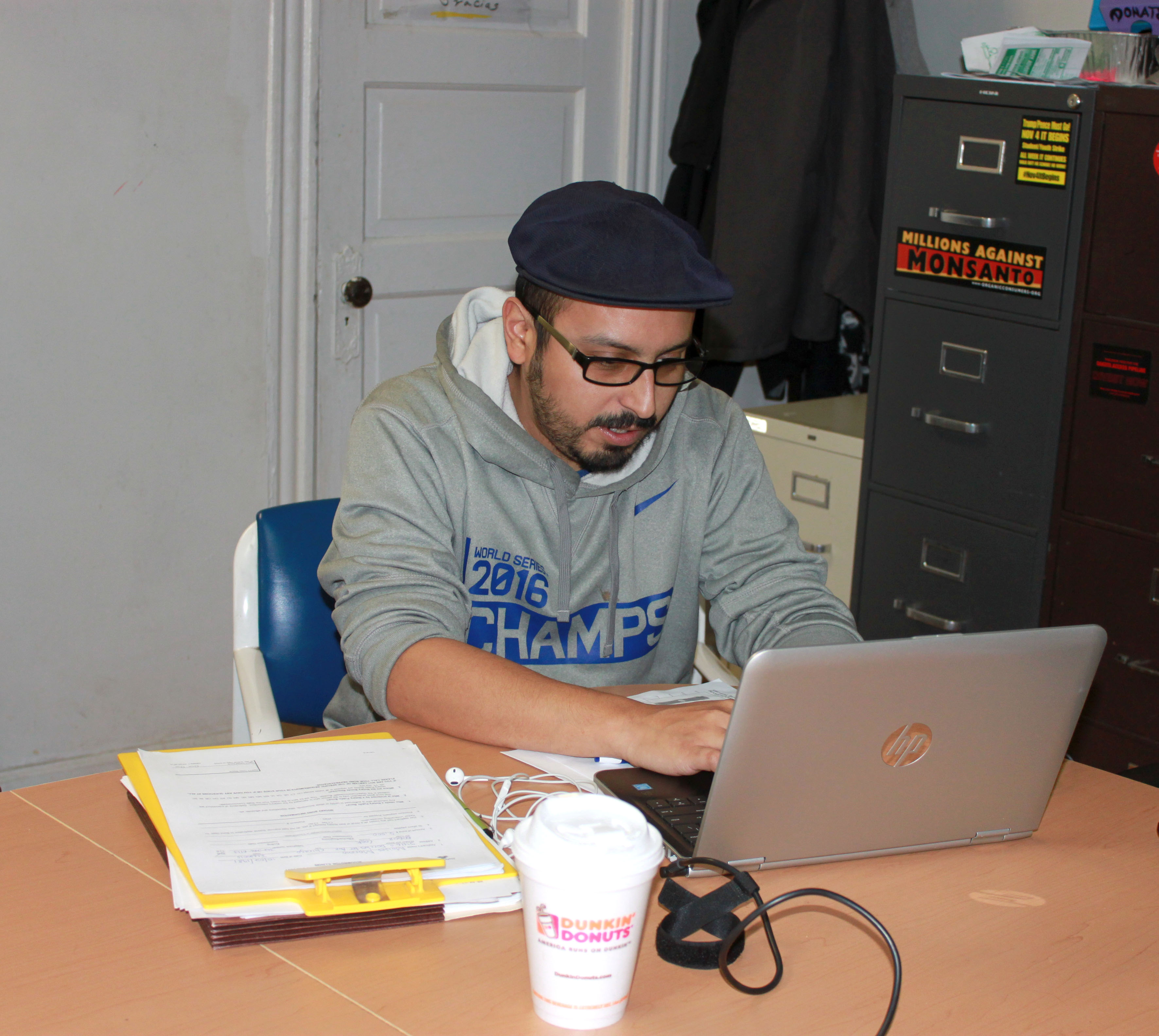

Moises Moreno. (Jocelyne Nuñez, 14 East)

With home prices rising in Pilsen more quickly than middle-class incomes, it only makes sense that the Latinx population is decreasing. According to census data cited in the Betancur and Youngjun study, the average white household living in Pilsen makes $41,760 a year, as opposed to the average Latinx household, which makes $32,126.

Unemployment also plays a role in the amount of income the household makes annually. In many Latinx households, the main provider in the family is male. According to the Bureau of Labor Statistics, the quarterly average unemployment rate in Chicago for Hispanic or Latino men has gone up. In 2016, the percentage of unemployed males between the ages of 35 to 44 years was at 3.2 percent. Now, in 2017, it has risen to 3.4 percent. The unemployment rate of men ages 45 to 54 years in 2016 was at 2.9 percent. In 2017, it has risen to 3 percent.

In many foreign-born Latinx households, both parents primarily speak Spanish. These families are left feeling vulnerable to the displacing effects of gentrification because there may be no understanding of why the increase in rent happens, or because families may not be able to communicate with developers due to language barriers.

“Lenders took advantage of these Latino families and their American dream of purchasing a home by setting them up for failure,” Guzman, who was born and raised in Pilsen, said. “These officers would document a false amount of gross income these families would make to get them approved for a home. [For] a $3,000 home that they couldn’t afford, the mortgage would be $1,000 to $1,500. How could the family pay that when working the minimum wage?”

John Castaneda. (Jocelyne Nuñez, 14 East)

“Developers will go as far as calling inspectors and making up false accusations just to get people out of their homes,” Guzman added.

Because of the huge demographic change, the increase in rents has occurred alongside local Latinx shops shuttering and getting replaced by more high-end shops.

“The way you can tell that gentrification is happening here is that I have never seen so many white people walking their dogs,” said veteran and retired cop John Castaneda, who was born in Mexico and moved to Pilsen in 1961. “It’s all yuppies, hipsters, students moving to Pilsen.”

Mom-and-Pop businesses have changed their products to cater to the newer, whiter population.

“If you notice our bread is not really your traditional Mexican bread, we’ve modified what we sell like our brownies, muffins, cookies,” said Michelle Herrera, an employee at the bakery Panaderia El Acambaro. “What we had before didn’t really sell. A lot of our customers are white, and this is their stop in the morning before getting on the Pink Line for work.”

Bakery El Acambaro. (Jocelyne Nuñez, 14 East)

Studies from the Bureau of Labor Statistics show that fewer families with children now live in Pilsen. Instead, more college students are moving in that area, along with young new couples. Non-family households with two or more people have increased from 2000 to 2012 from 6.4 percent to 12.8 percent.

“You’re getting a student crowd,” Castaneda said. “It’s very accommodating to live here, you can just jump on the Pink Line and go.”

All of these changes could be looked at as positive because it means the neighborhood is becoming more diverse, or it can be viewed as a loss to those Latinx families that call Pilsen their community.

The push against gentrification and increasing home values isn’t universal. Samhar Mahmud, who has lived in Pilsen for 20 years, notices the change in people who live in Pilsen now more than when she first moved to the area, but says that the neighborhood hasn’t lost its cultural integrity.

“When we first moved into the neighborhood, we were one of the only families that didn’t speak Spanish and were not of Hispanic background,” Mahmud said. “My family is mixed with Korean, Danish, Brazilian and Palestinian. Growing up and seeing the change, I think it’s cool because I think the community has been able to maintain its roots without completely changing.”

Castaneda, the longtime Pilsen resident, has a different approach to this issue, focusing on the potential financial gain for local homeowners.

“You can’t blame a homeowner for selling his property to a developer that he or she bought 50 years ago if they bought it for $40,000,” he said. “Now they’re in their 70s, somebody comes by and says ‘I’ll give you $500,000 for your property,’ of course they’re going to jump. With half a million they can go to the ‘burbs get a condo. … The culture will always be there, there are organizations that keep that alive. I maintain my culture, and I’m a veteran.”

And yet, many say the neighborhood’s culture Castaneda refers to has slowly started to fade. Many of Pilsen’s iconic Mexican murals, for instance, have been destructed or painted over from buildings that have been taken knocked down or bought by lenders in the neighborhood.

“I see it coming, I see Pilsen becoming the Loop in 10 years,” Guzman said. “You see the skyscrapers more so than you did before, and Little Village will become Pilsen. See, back in the ‘80s the Germans left Pilsen because they didn’t want to mingle with our culture. This is different – we are being forced out.”

Pilsen is still hanging onto its cultural roots as long as it can. The slow pace of gentrification has been because of the sufficient resistance from the community and the work of groups like The Resurrection Project. Ultimately, development has to occur in a balance. The UIC study perhaps says it best: “Although welcoming improvements like everybody else, [Pilsen residents] want development without displacement.” Pilsen wants improvement,without the harm of families falling apart.

“People are becoming more aware of this issue,” said Moises Moreno, a coordinator at Pilsen Alliance, which is a social service organization in Chicago. “I think people want to be heard now. I have witnessed the powerlessness that people feel. They are getting fed up. They see their neighbors disappearing, schools being closed. There is going to be a political change. It won’t be easy, but I actually think we have a shot.”

Header photo by Jocelyne Nuñez

NO COMMENT